Best Gold Under $500

Looking to start investing in gold without spending a fortune? With so many options available, it can be hard to know where to begin. We’ve reviewed the most trusted and cost-effective gold coins under $500 to help you make an informed decision. Whether you’re a first-time buyer or want to cost average on a consistent basis, this guide highlights the best options based on value, recognition, and long-term potential.

Best for: First-Time Buyers or Cost-Averaging Investors

1/10 Oz Gold Eagle (Random Year)

Why We Like It: Widely recognized and easy to buy again next month, this coin is basically the $20 bill of Gold . It’s backed by the US government making it easy to trust, trade, and buy again.

Buyer Type: Beginners • Stackers • Monthly Buyers

Best for: Buyers Who Want Verified Authenticity and Long-Term Value

1/10th Oz Gold Eagle – MS70 (Random Year)

Why We Like It: Certified gold in perfect condition – graded MS70 by a 3rd party grading service and sealed in tamper-proof plastic. A strong long-term hold for anyone who wants verified authenticity and lasting value.

Buyer Type: Long term holders • Resale Confidence • Monthly Buyers

Best for: Investors Who Want More Than Just Melt Value

Pre-1933 U.S. Gold Coin – Raw AU (Almost Uncirculated)

Why We Like It: Pre-1933 U.S. gold in AU condition carries numismatic upside – it’s priced not just for its gold content, but also for its scarcity and collector demand. Though technically numismatic, it often trades at premiums similar to modern bullion.

Buyer Type: Rarity • Long-Term Holders • Value Seekers

Best for: Buyers Who Value Low Mintages & Collectible Scarcity

1/10 oz Proof Gold Eagle – In OGP (Random Year)

Why We Like It: Proof Gold Eagles are struck in limited numbers with a high-quality finish. They’re a strong choice if you want something rarer than bullion but more accessible than high-end collectibles.

Buyer Type: Scarcity-Focused Investors • Retirement Planners

Best for: Those Who Want 24K Gold

1/10 oz Canadian Gold Maple Leaf (Random Year)

Why We Like It: The Canadian Gold Maple Leaf is a globally recognized bullion coin, struck in 99.99% pure gold. It’s a popular alternative to the Gold Eagle for buyers who want to stack ultra-pure gold.

Buyer Type: Beginners • Purity Focused • Monthly Buyers

NumisAdvisor’s Top Pick:

Best for: First-Time Buyers or Cost-Averaging Investors

1/10 Oz Gold Eagle (Random Year)

Why We Like It: Widely recognized and easy to buy again next month, this coin is basically the $20 bill of Gold . It’s backed by the US government making it easy to trust, trade, and buy again.

Buyer Type: Beginners • Stackers • Monthly Buyers

Gold Buyer’s Guide: What to Know Before Buying Gold Under $500

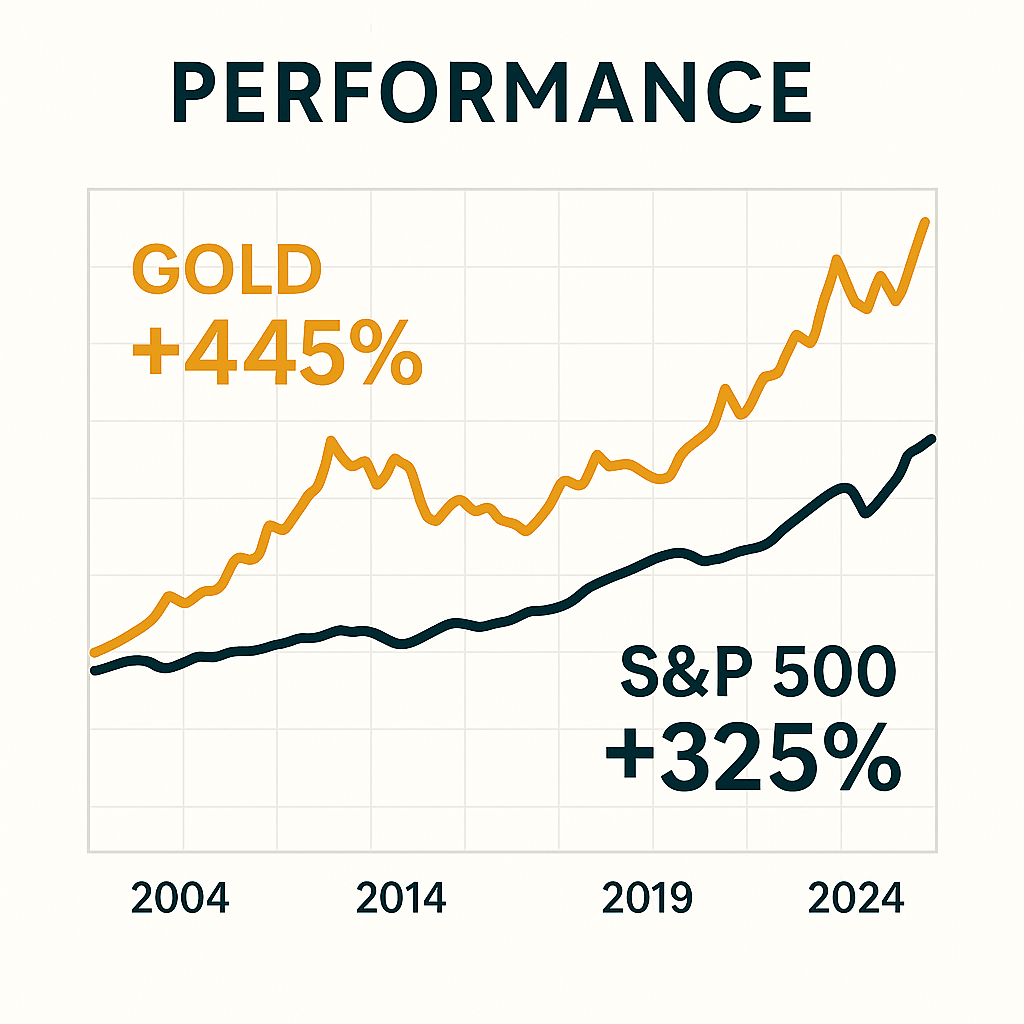

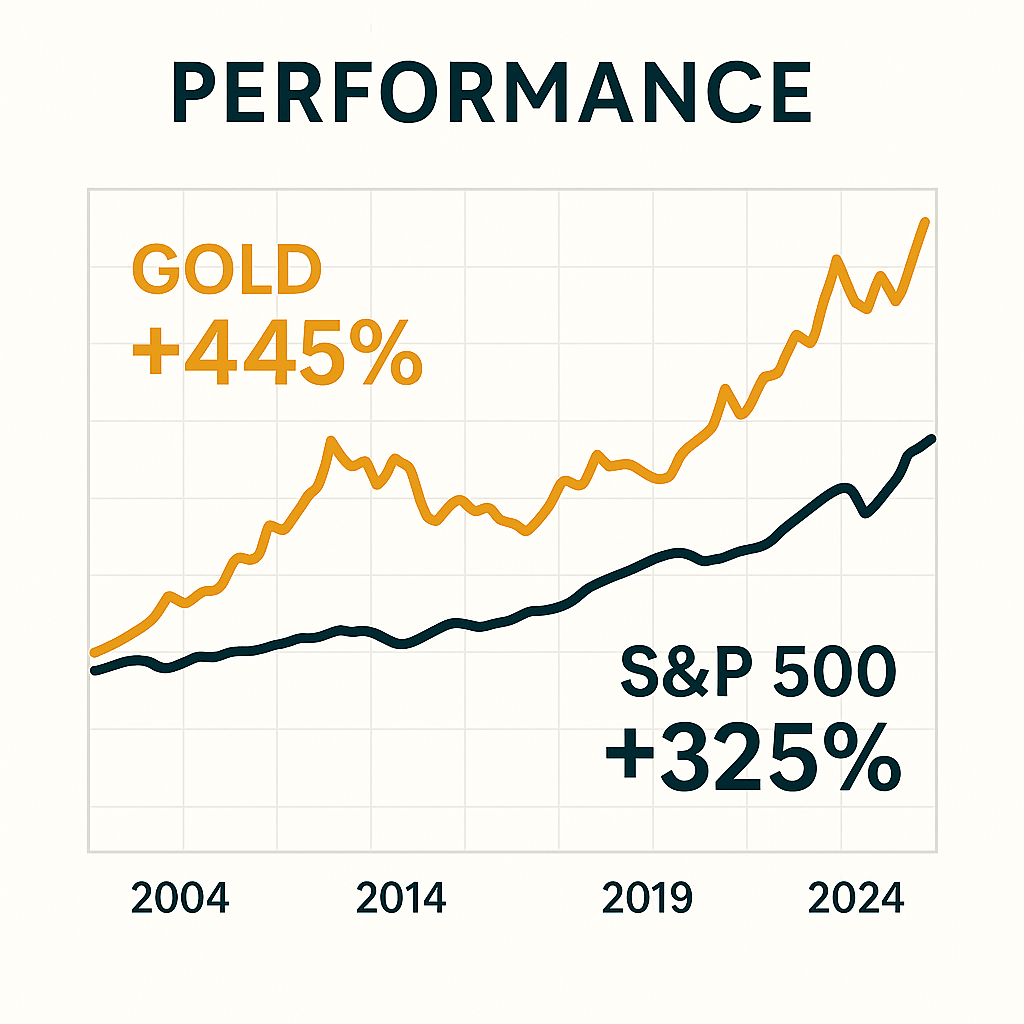

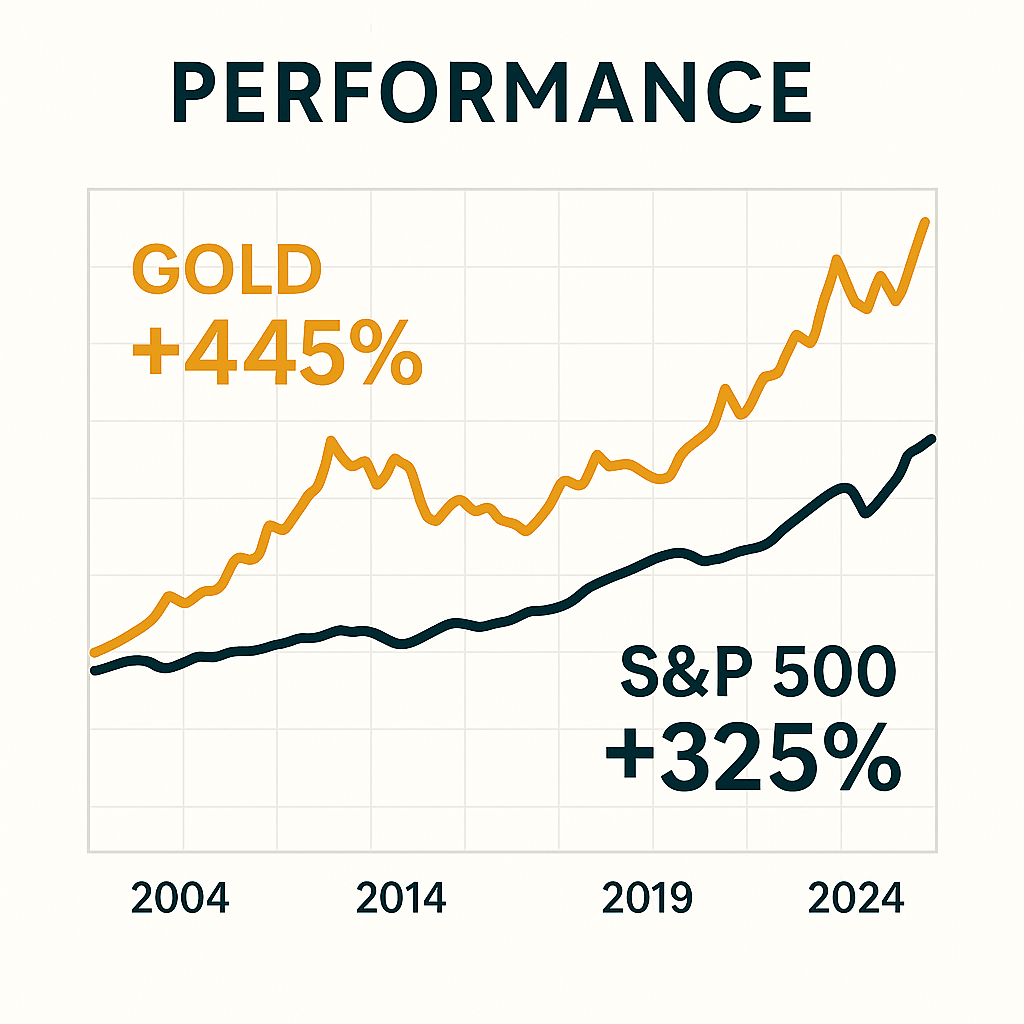

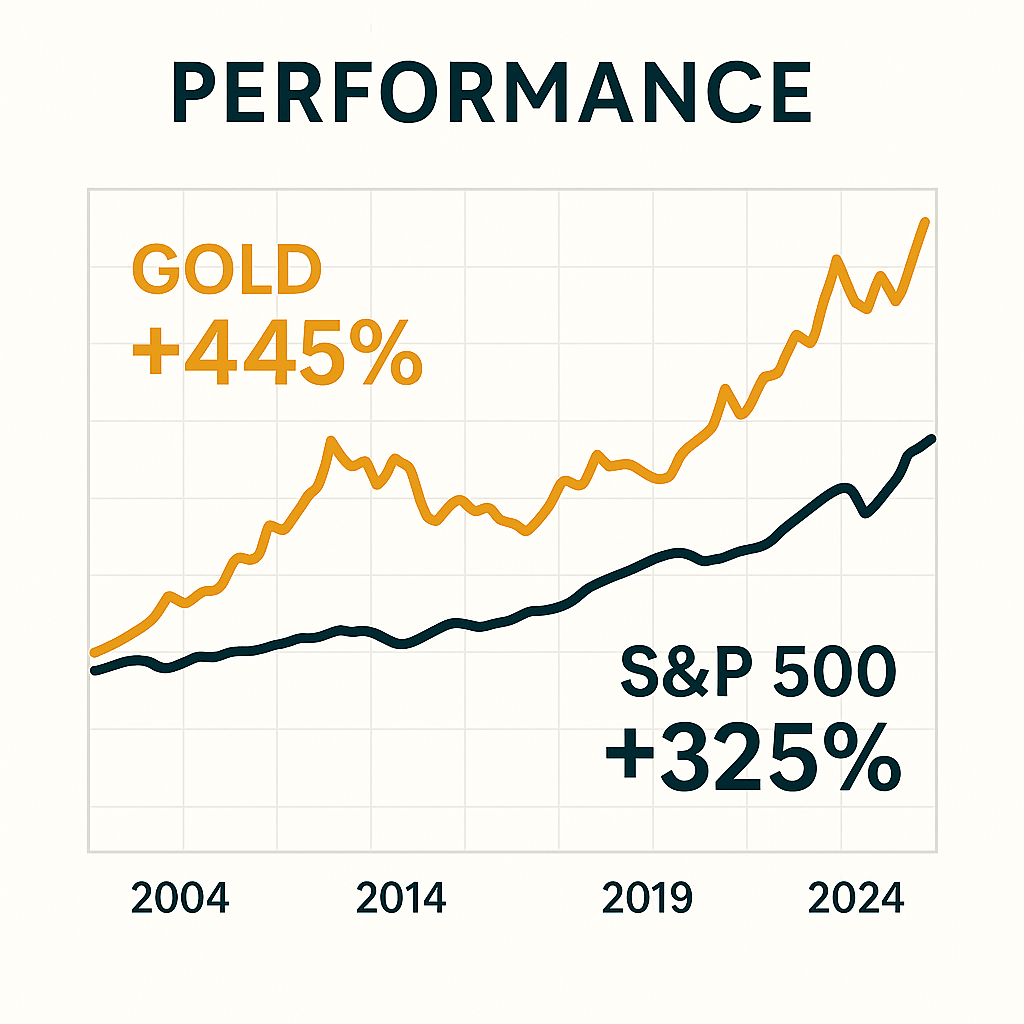

Buying gold under $500 is one of the smartest ways to begin building your precious metals portfolio — but knowing what to expect before you buy can save you from overpaying, overthinking, or choosing the wrong coin for your goals.

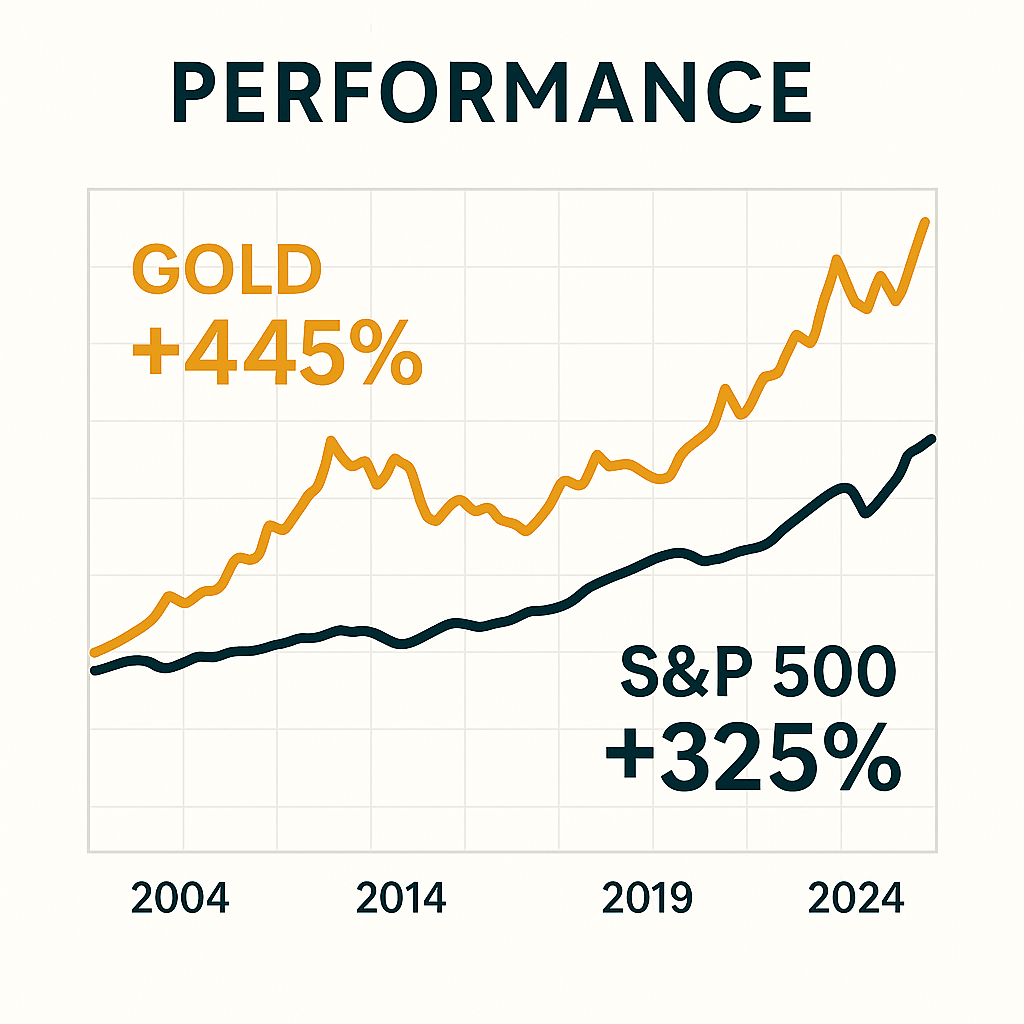

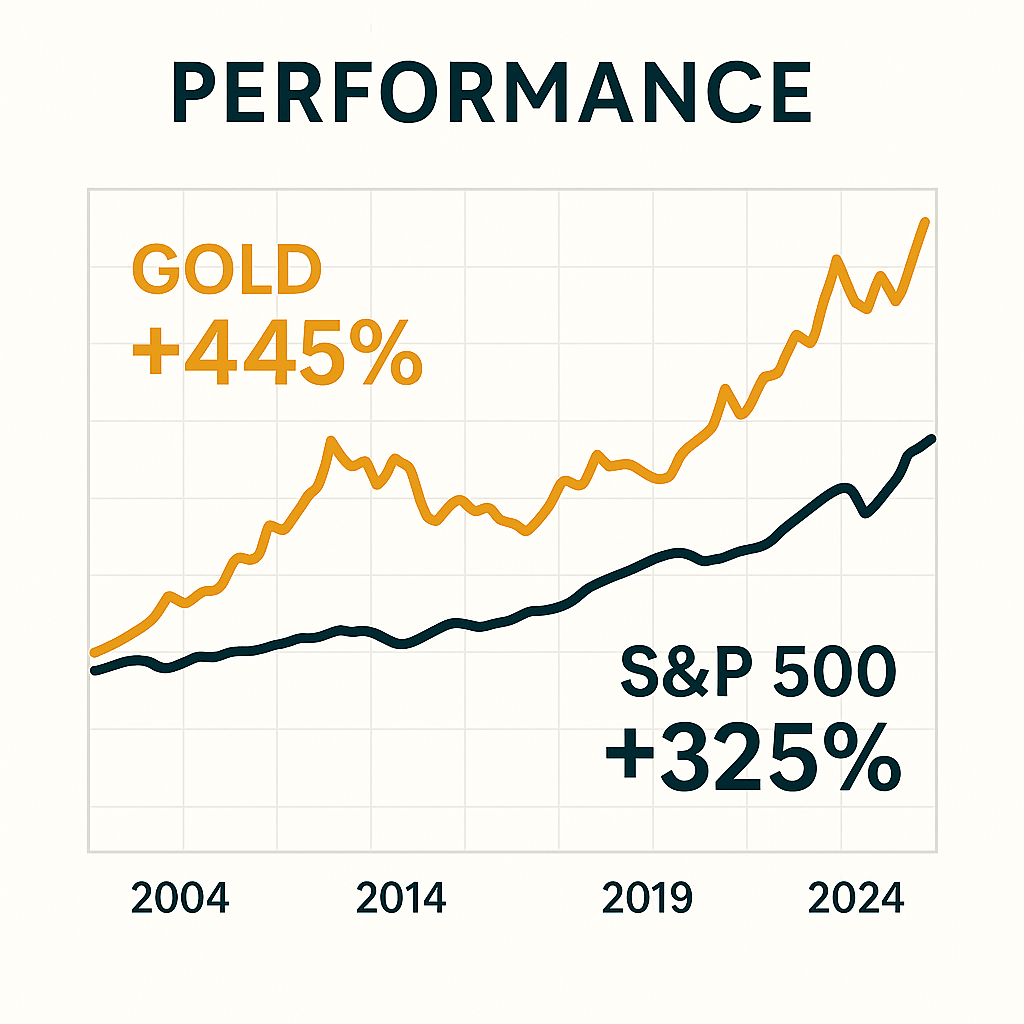

With gold prices reaching all-time highs, many investors assume you need thousands of dollars to get started. Fortunately, fractional gold coins — typically in 1/10 oz or 1/4 oz sizes — offer an accessible entry point, giving you the ability to own real, government-backed gold for less than the price of a new smartphone.

That said, there are important trade-offs and considerations you need to understand before choosing the best gold coin under $500. This guide breaks it all down so you can make a smart, informed purchase.

Why Is Gold Under $500 More Expensive Per Ounce?

When you’re shopping for fractional gold (like 1/10 oz coins), you’ll notice the price per ounce is higher than what you’d pay for a full 1 oz coin. This is because of something called the premium — the markup above the current gold spot price.

Here’s why premiums are higher on lower-priced coins:

For example

If gold is $3,000/oz, a 1 oz Gold Eagle might cost around $3,120 (a $120 premium).

But a 1/10 oz Gold Eagle might cost $415 — which equates to $4,150 per ounce (an $80 premium).

What Can You Buy for Under $500?

You won’t be getting a full ounce at this price point, but you do have a few solid options:

- 1/10 oz Gold Eagles or Maples – Trusted government coins with strong resale value

- Graded Fractional Coins (MS70) – Certified perfect coins with added peace of mind

- Pre-1933 U.S. Gold (AU) – Historic coins like $5 Liberties that offer both gold content and collector appeal

- Gold Bars (5g–10g) – Lower premiums, but less recognized than government coins

Each of these options offers a different balance of purity, recognizability, and resale potential — which matters even more when you’re buying on a budget.

What About Resale Value?

When you buy gold, you’re not just buying metal — you’re buying marketability.

Coins like the 1/10 oz Gold Eagle or $5 Liberty are widely recognized, making them easier to sell when the time comes. Graded coins in MS70 condition may carry a small premium now but can hold their value better if gold prices soften.

On the other hand, gold bars or obscure foreign coins might cost less upfront, but you could take a hit on resale if buyers don’t recognize them or trust the mint.

Fractional Gold: Pros and Cons

|

Pros

|

Cons

|

|---|---|

Bottom Line

Buying gold under $500 is a smart way to get started, diversify, or cost-average your position — but it’s important to understand how premiums, coin types, and resale value affect your overall investment.

Whether you’re buying a 1/10 oz Gold Eagle, a raw $5 Liberty, or a graded MS70 fractional coin, each option offers real gold you can hold — and that’s the goal.